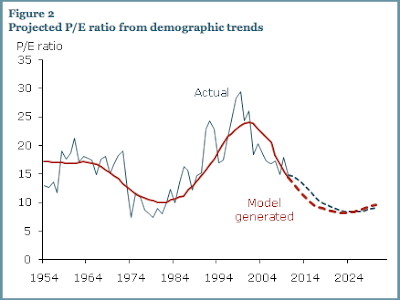

The SanFran Fed has published a research note on the value of US equities (with accompanying graph, above) that has attracted a fair bit of attention. Some key bits:

This evidence suggests that U.S. equity values are closely related to the age distribution of the population. Since demographic trends are largely predictable, we can forecast the path that the P/E ratio is likely to follow in the next few decades based on the predicted M/O ratio. ...

Despite theoretical ambiguities, U.S. equity values have been closely related to demographic trends in the past half century. There has been a tight correlation between population dependency ratios, such as the M/O ratio, and the P/E ratio of the U.S. stock market. In the context of the impending retirement of baby boomers over the next two decades, this correlation portends poorly for equity values. Moreover, the demographic changes related to the retirement of the baby boom generation are well known. This suggests that market participants may anticipate that equities will perform poorly in the future, an expectation that can potentially depress current stock prices. In that sense, these demographic shifts may present headwinds today for the stock market’s recovery from the financial crisis.

What this is basically saying is that stock market prices (relative to firm income per share) have tracked US demographics relatively closely over the past few decades. This is bad news for those invested in US equities because the US population is getting older, which means that there is likely to be more people seeking to sell equity investments to fund retirement than people looking to buy. If the supply of equities for sale shifts right, and the number of people with enough wealth to demand equities shifts left, then the price of equities is likely to fall. That's what the "model generated" portion of the graph above is showing.

But I don't buy it. As Ryan Avent notes, demographic trends are no secret, yet if supply is going to outstrip demand when retirees liquidate their equity portfolios the markets don't seem to have internalized the expectation.

More importantly, it's not clear to me that US demographic trends are the most relevant variable going forward. Capital is more internationalized now than at any point in history, and there are many more people in the global middle class than ever before, a trend that is expected to continue over the next 2-3 decades. For many of these people investing in US equities will be attractive, especially if the prices are low. Let's also remember that the US runs a very large current account deficit and is likely to continue doing so for the foreseeable future. That will have to be offset with financial transactions, and equities are one way to do that.

The authors mention the possibility of increased foreign ownership in passing, but it doesn't factor into their methodology. I think it probably should.

0 comments:

Post a Comment