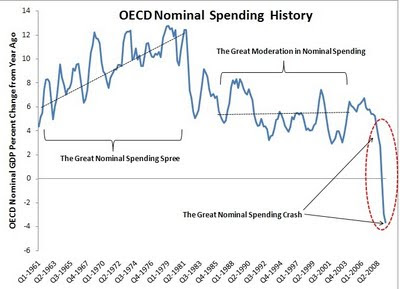

The above picture, from David Beckworth, is shocking. It shows that nominal spending (total demand in an economy) among OECD countries had a jarring drop last year, and that this is the proximate cause of the economic slowdown. (For a short post on why nominal spending matters, see this post). Beckworth is arguing that the Fed screwed up majorly by targeting inflation rather than spending, and is still making the same mistake.

Krugman hates this, although he admits it' power with this parenthetical: "monetary policy doesn’t matter (unless it can affect expected future inflation, but that’s another story)". BUT THAT IS THE STORY! As Beckworth writes:

If an economy is running at full employment, then any sudden increase or decrease in nominal spending will give rise to changes in real economic activity that are not sustainable. This is because there are numerous rigidities that prevent prices from adjusting instantly. There is simply no way to suddenly jar nominal spending (i.e. create a nominal spending shock) and not have real economic activity move as well.

Note that the key here is not to aim for inflation stability, but to aim for nominal spending stability. This is because inflation is merely a symptom of nominal spending shocks.

Krugman tries to trump this as he always does, by saying that in a liquidity trap monetary policy cannot get any traction. But it can if it commits to a certain nominal target over time. This is what Scott Sumner has been saying since his first post (and he does not disappoint in his response to Krugman). And as the Free Exchange blog argues, Krugman cannot possibly prove that the central bank is powerless when they haven't even tried to affect inflation expectations. Instead, the Fed has repeatedly sounded hawkish when it comes to inflation. If Bernanke came out tomorrow and said "inflation is soon going to spiral upwards, and there's nothing we can do about it" then present spending would almost certainly jump. Instead, the Fed is committing to holding inflation down when if anything it should be committing to holding it up. Given the Fed's anti-inflationary history, this commitment is viewed as credible. Faced with that reality, spenders are quite rationally holding on to cash, and this has depressed the economy.

In other words, Krugman is arguing that something that hasn't been tried cannot succeed. But there are very good reasons for thinking it can: if the Fed were to make a commitment to future nominal spending (or even explicit inflation targets), it would move money in the present. If money moves in the present, then nominal GDP goes up. If nominal GDP goes up, then the economy grows back into full employment.

0 comments:

Post a Comment