Back in February, I noted that Obama was engaged in a sort of intertemporal carry trade with the U.S. currency: he was gambling that the money he borrows in the present will be worth more than the money he has to pay back in the future. At the time, this made sense, since he could borrow at interest rates near zero (occasionally even at or below zero), and future inflation expectations were positive. Therefore, the present value of money actually was higher than the (expected) future value. Obama was arbitraging the system, and could have his cake and eat it too; he could spend today, pay back tomorrow, and earn a bit of profit on the side. He was able to do this because nobody wanted to lend to private corporations due to risk, and U.S. government bonds are perceived as being nearly "risk-less".

But there are signs that those days may be over. In March there was a failed bond auction in the U.K., indicating that bond traders were not interested in funding more deficits at rates the British government was willing to pay. Last week, something similar happened in the U.S.: the demand for T-bills was tepid, and investors demanded higher interest rates before buying. Why is this happening? For one, now that the dust has somewhat settled from the financial meltdown, investors are more willing to lend to (some) corporations. This creates competition for investment funds ex ante, which means that the government will have to pay a higher price to get the funds it needs to spend in deficit.

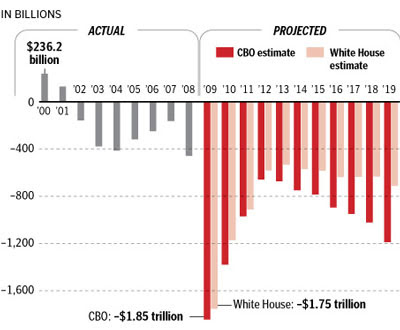

There is another aspect to this, however. Because of Obama's expansive deficits, which according to CBO estimates (see picture above) will still be well over $1tn in 2019, there is a rising fear that the U.S. will have to either default on its debt or inflate it away. In other words, there is a growing risk that the U.S. government debt will stop being considered "risk-free," and investors will demand a risk premium on T-bills. If that happens, then Obama will either have to scale back his spending programs (as Gordon Brown has done), raise taxes on a broader slice of the population than just the top 5%, or both.

Obama's carry trade bet looked like a win-win a few months ago. But that was contingent on demand for T-bills remaining high, keeping yields down, and allowing the government to arbitrage a profit (or very small loss). If that doesn't hold, then the whole thing will blow up in Obama's face, and the consequences for common Americans won't be pleasant either.

As many investors discovered last fall, the risks of carry trading are always the same: you don't want to be holding the potato when the music stops. The costs of unwinding are high.

IPE @ UNC

IPE@UNC is a group blog maintained by faculty and graduate students in the Department of Political Science at the University of North Carolina at Chapel Hill. The opinions expressed on these pages are our own, and have nothing to do with UNC.

Bookshelf

Tags

Academia Adjustment Afghanistan Africa AIG America Argentina Austerity Bailout Banking Bargaining Basel Bernanke Bias Blogging Business cycle; recession; financial crisis Cap and Trade capital controls capital flows central banks; moral hazard Chavez China China Trade Climate Change Contentious Politics Cuba Currencies Currency Crises; financial crisis Current Account Data Debt Debt; China; United States; Decession Politics Decoupling Deflation democracy Democrats; Trade policy development Diplomacy Dollar; China; Currency Manipulation; Exchange Rates dollar; exchange rate policy ECB ECB; Fed; Monetary Policy Economic Growth Economics Egypt election EMU; monetary union Environment EU; Agriculture; Common Agricultural Policy Euro Europe; labor; immigration European Union Exchange Rates Farm Bill; Agriculture FDI Fed; Monetary Policy finance financial crisis financial crisis; subprime Fiscal Policy; monetary policy; elections Fiscal Stimulus Foreign Aid Foreign Policy France Free Trade Agreements G-20 G20 Summit Game Theory Germany global recession globalization Grand Theory Great Britain Greece health care reform Hegemony Human Rights Iceland imbalance IMF immigration Incentives income distribution income inequality; globalization India Inequality inflation institutions Interests international finance International Law International Monetary System International Relations Investment IPE Iran Iraq Ireland ISA Italy Japan labor markets Latin America Libya Macroeconomics Marxism Mexico Microfinance Miscellany monetary policy Monetary policy; Federal Reserve moral hazard Narcissism Networks Nobelist Smackdown North Korea Obama Oil PIGS Pirates Political Economy Political Methodology Political Science Political Survival Political Theory Power Protectionism Protests Public Choice Public opinion Rational Choice regulation Research Review Russia Sanctions Security Dilemma security threats Soccer Social Science Sovereign Debt Spain Sports Statistics stock markets Systems Tariffs TARP Taxes TBTF Technocracy technology terrorism Trade trade policy UNC Unemployment United States US-South Korea Venezuela WTO WTO; Doha

Blog Archive

-

▼

2009

(521)

-

▼

May

(36)

- How Much of an Outlier Was 2008?

- Just How Irrelevant Am I?

- Oil is creeping back up.

- Self-Outsourcing?

- Differing Views on China

- On the (Ir)relevance of IR Scholarship to Policy M...

- Bad News for Microfinance Proponents

- Political Incentives and the Israel/Palestine Situ...

- Handicapping the Upcoming E.U. Parliament Elections

- Social Science Smackdown Week!

- Props

- We Can't Stop Carbon Emissions (redux)

- Mo' Money, Less Problems

- Quote of the weekend.

- More on US/EU Unemployment

- Links for the Weekend

- Interesting Links.

- Seppeku

- US Unemployment Rate Higher than Europe's?

- Helping the Poor by Giving Them Money

- Happiness Is Keeping Poor People Away

- Blame Game

- Nye and Drezner on Policy Relevance, Academia and ...

- From "Obscure Journal" Article to Mainstream Policy

- Is Obama the New Nixon?

- Cognitive Dissonance and the Financial Crisis

- The Risks of the Intertemporal Carry Trade

- In Which French Winemakers Act, Well, French

- Who Gets E.U. Farm Subsidies?

- More 'Crisis of Capitalism' Hyperbole

- Pass the Cheese

- This Is How We Do It

- Hedge Funds Fight Back

- We Can't Stop Carbon Emissions

- Everybody Get Down

- Videos for the Weekend: Recent TED Talks

-

▼

May

(36)

Tuesday, May 12, 2009

The Risks of the Intertemporal Carry Trade

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment